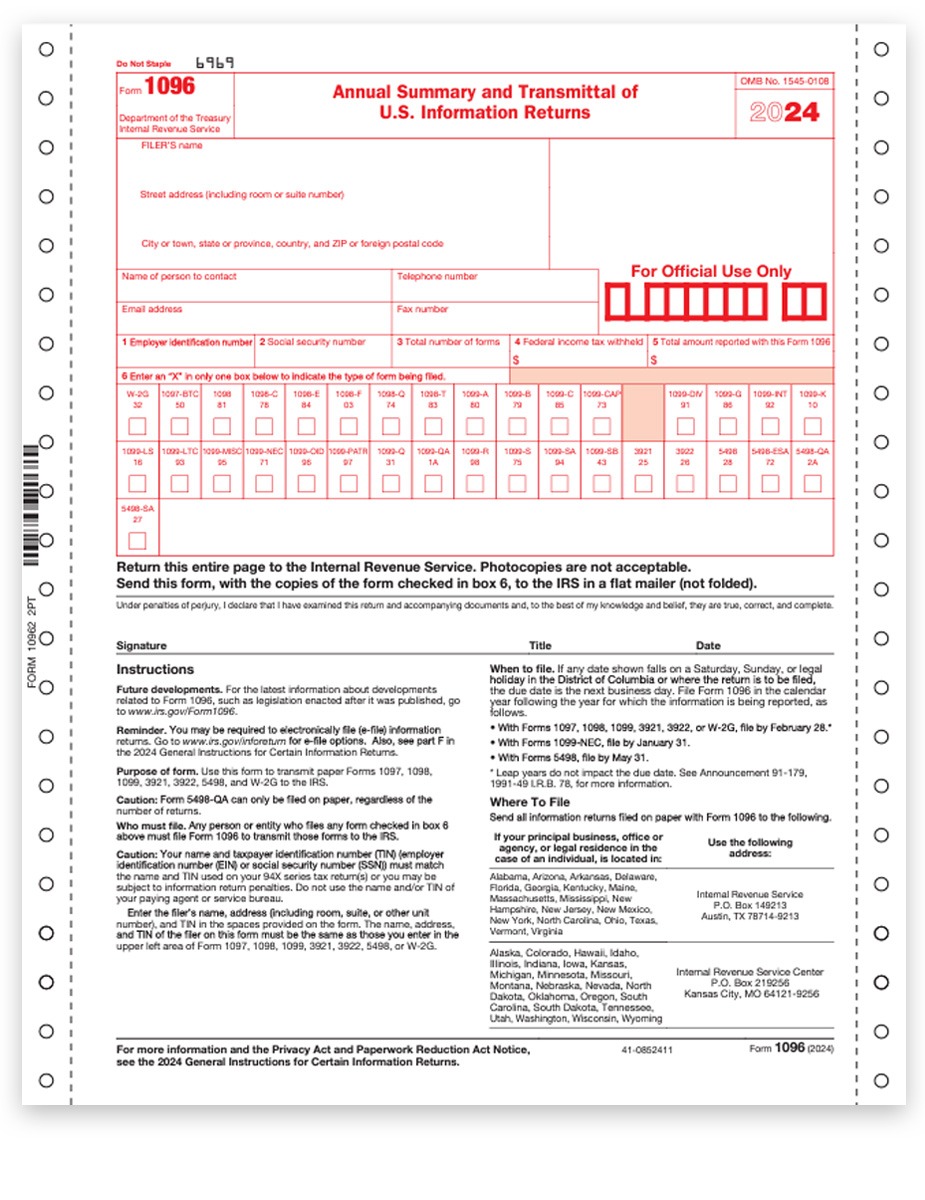

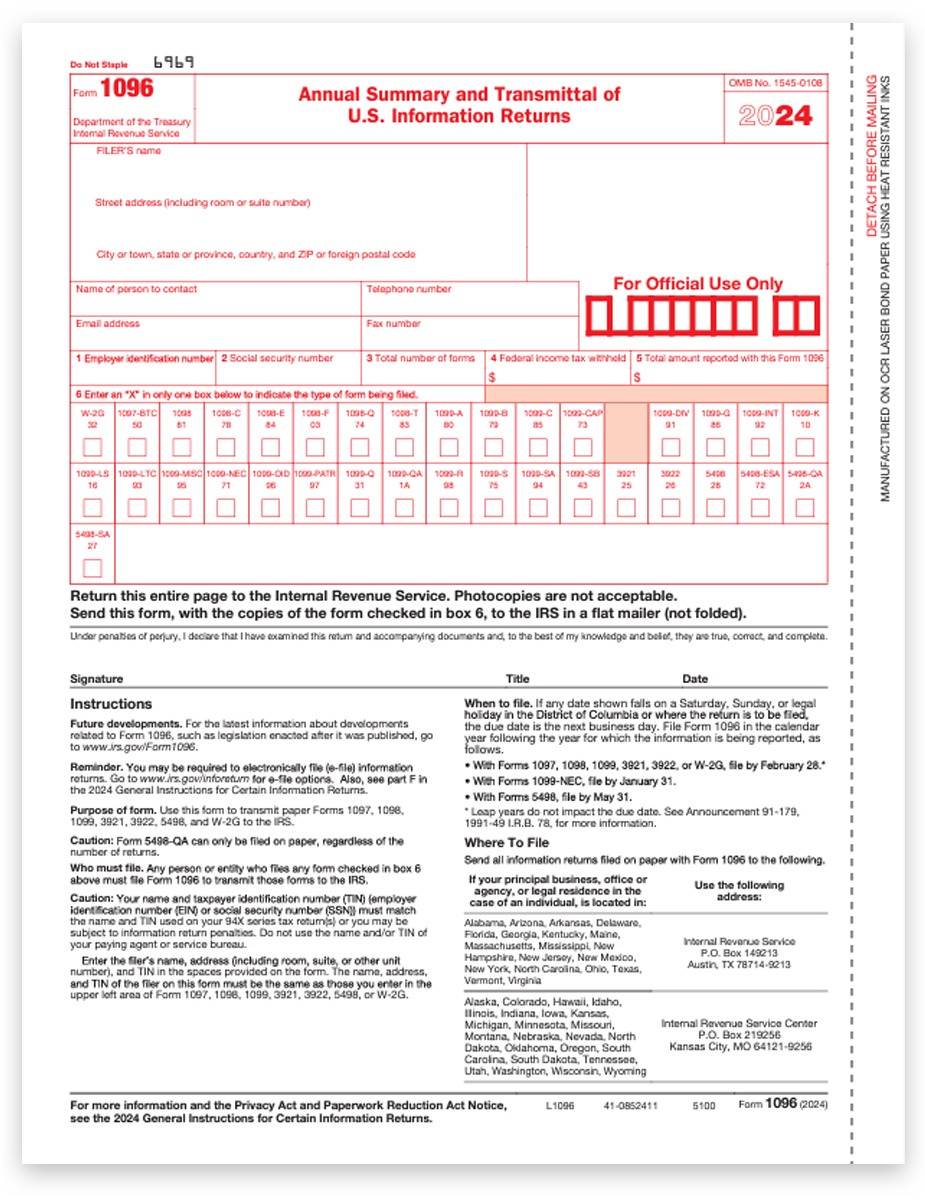

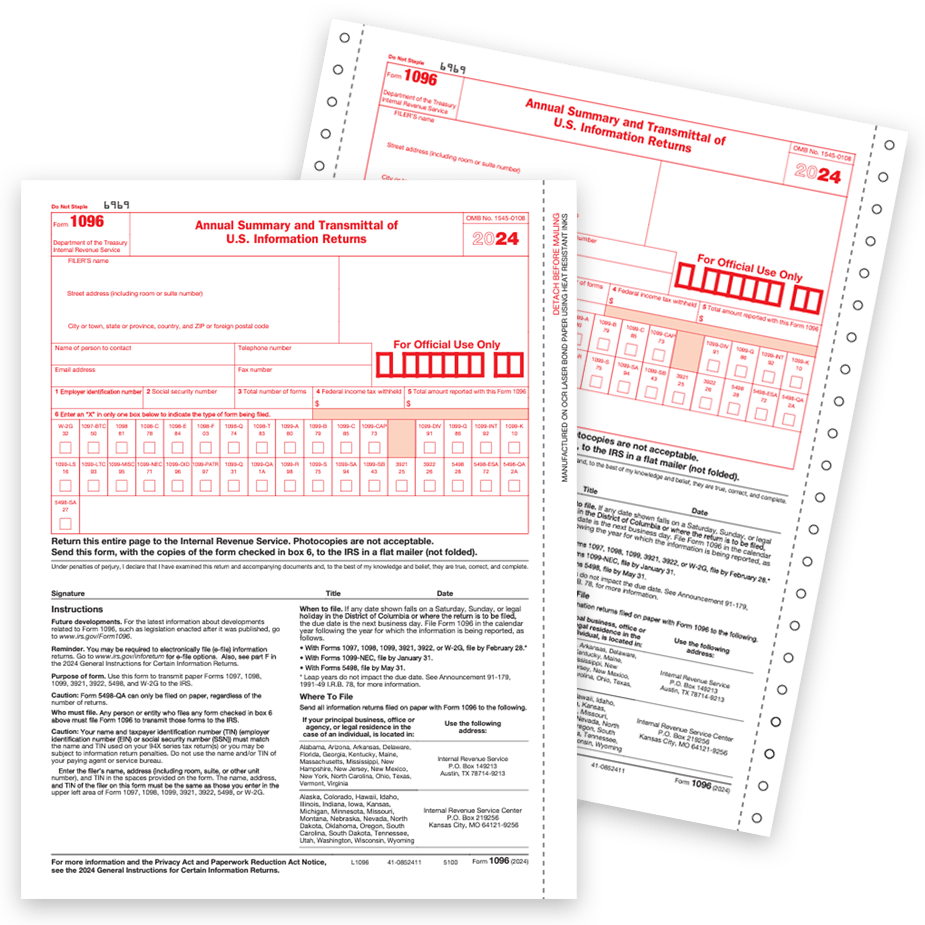

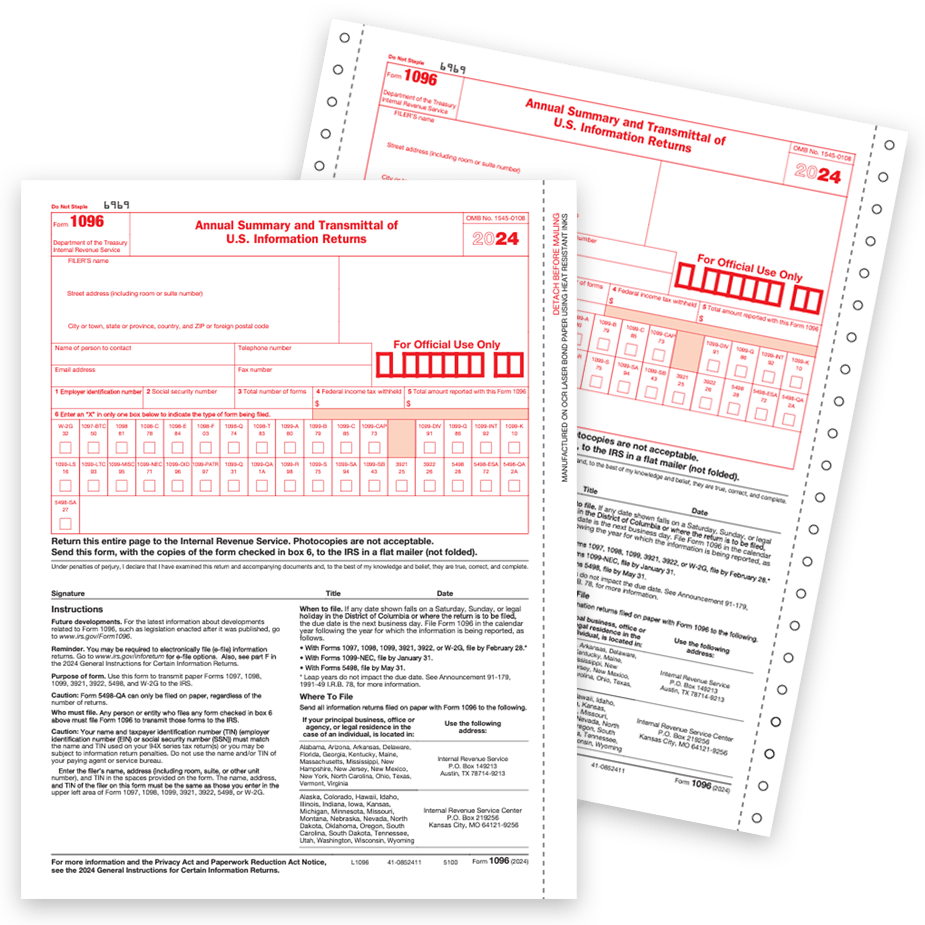

1096 Transmittal Forms

Summary 1096 Tax Forms for 1099 Filing in 2024

Each payer is required to include a 1096 Transmittal Form to summarize each batch, of each type of 1099 form when mailing them to the IRS on January 31.

If you e-file 1099 forms online, you DO NOT need 1096 forms.

1099 E-filing requirements — e-file Copy A for 10+ W2 and 1099 forms combined. We make 1099 e-filing easy!

Have 10+ W2 & 1099 Forms to File? You Must E-file!

The IRS requires e-filing for 10+ W2 &1099 forms, combined, per EIN.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except corrections. Efile Copy A forms by January 31, 2025.

ONLINE E-FILING = EASY 2024!

Efile, print and mail 1099 & W2 forms online.

No paper, no printing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file Copy A in 2024.

Use DiscountEfile.com to enter or upload data from QuickBooks® or other programs, and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

Deadlines for 2024 1099 & W-2 Filing

January 31, 2025

All 1099 Recipient Copies B / C / 2 mailed to recipient

W-2 Employee Copies B / C / 2 mailed to employees

1099NEC Copy A forms to IRS*

W2 Copy A to IRS*

>> E-FILE RULES FOR 2024 << Businesses with 10+ 1099 and W2 forms combined MUST e-file Copy A forms with the IRS or SSA. Make it easy with DiscountEfile.com...

February 28, 2025 - Paper 1099 Copy A forms to IRS

1099 Form Copy A, along with 1096 Transmittals, mailed to the IRS for all 1099 forms except 1099-NEC with non-employee compensation, which are due January 31.

April 1, 2025 - E-file 1099 forms with IRS

1099 Forms E-filed to the IRS, except 1099-NEC with non-employee compensation, which are due January 31.

Let Us Do the Work for You This Year!

Instantly print, mail and e-file your 1099 and W-2 forms.

Simply enter your data, or import it from QuickBooks®, then click a few buttons and you're done.

We print and mail recipient copies, plus e-file with the government, for around $4 per form.